Need-Based Financial Aid Scholarships

Need-based financial aid scholarships represent a lifeline for many students, bridging the gap between aspiration and affordability. Securing these crucial funds often hinges on understanding the intricate application processes, eligibility criteria, and diverse sources available. This guide navigates the complexities of need-based aid, empowering students to confidently pursue higher education.

From understanding the core principles of need-based financial aid and the documentation required to demonstrate financial need, to identifying major sources like government programs and private organizations, we will cover the entire process. We will also explore effective strategies for maximizing your chances of receiving aid, including tips for crafting compelling scholarship essays and navigating the application process itself. The ultimate goal is to provide a comprehensive resource that empowers students to access the financial support they need to achieve their educational goals.

Defining Need-Based Financial Aid Scholarships

Need-based financial aid scholarships are awarded to students who demonstrate a significant financial need to pursue higher education. Unlike merit-based scholarships which reward academic achievement, need-based aid focuses on the student’s and their family’s ability to pay for college expenses. The core principle is to ensure that financial constraints do not prevent qualified individuals from accessing educational opportunities.

Core Principles of Need-Based Financial Aid

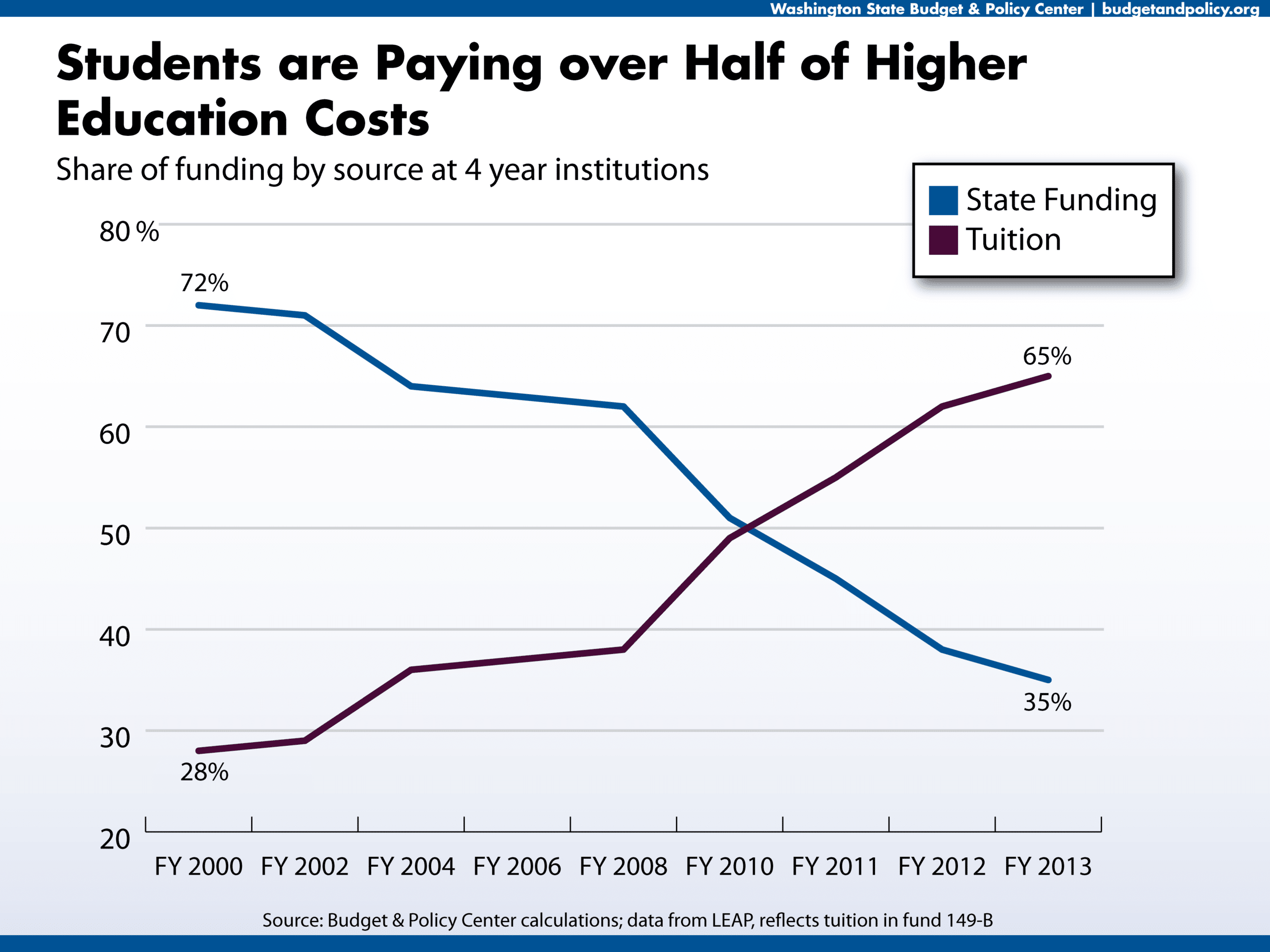

The fundamental principle underlying need-based financial aid is to bridge the gap between a student’s expected family contribution (EFC) and the cost of attendance (COA). The EFC represents the amount a family is reasonably expected to contribute towards college expenses based on their income, assets, and family size. The COA includes tuition, fees, room and board, books, and other essential educational expenses. The difference between these two figures determines the student’s financial need, which then informs the amount of aid awarded. The goal is to make college accessible to students regardless of their socioeconomic background.

Criteria for Determining Financial Need

Several factors are considered when determining a student’s financial need. These include:

* Family Income: This encompasses parental income from all sources, including salaries, wages, self-employment income, and investments.

* Family Assets: This includes savings accounts, checking accounts, investments (stocks, bonds, mutual funds), and real estate (excluding the family home, often with some limitations).

* Family Size: The number of dependents in the family is a significant factor, as it influences the expected contribution per person.

* Number of Students in College: If multiple family members are attending college concurrently, the financial burden is usually higher.

* Unusual Circumstances: Some applications allow for consideration of unusual circumstances, such as high medical expenses or unexpected job loss, that might significantly impact the family’s ability to pay for college.

Documentation Required to Demonstrate Financial Need

To determine financial need, applicants typically need to provide the following documentation:

* Federal Application for Federal Student Aid (FAFSA): This is a crucial form that collects detailed information about the family’s financial situation.

* Tax Returns (IRS Form 1040): These documents provide verifiable income information for both parents.

* W-2 Forms: These forms confirm the income earned from employment.

* Bank Statements: These show the family’s assets in various accounts.

* Supporting Documentation for Unusual Circumstances: This could include medical bills, proof of job loss, or other relevant documents to substantiate claims.

Comparison of Need-Based Financial Aid Types

The following table compares different types of need-based financial aid:

| Aid Type | Source | Repayment | Impact on Future Aid |

|---|---|---|---|

| Grants | Government, colleges, private organizations | None | Generally no impact |

| Scholarships | Colleges, private organizations, corporations | None | Generally no impact |

| Loans | Government (e.g., Federal Stafford Loans), private lenders | Yes, with interest | May affect future aid eligibility depending on loan type and repayment history |

Sources of Need-Based Financial Aid Scholarships

Securing funding for higher education can be a significant hurdle, but numerous sources offer need-based scholarships to alleviate this burden. These scholarships recognize financial limitations and provide crucial support to deserving students. Understanding the various avenues for accessing this aid is key to successful application.

Need-based financial aid scholarships stem from a variety of sources, each with its own application process and eligibility criteria. The primary sources are government agencies, educational institutions, and private organizations. These entities recognize the importance of equitable access to education and contribute significantly to supporting students from diverse socioeconomic backgrounds.

Government Programs Offering Need-Based Aid

Government programs represent a significant source of need-based financial aid. These programs are often funded through federal and state tax revenues and are designed to make higher education more accessible to a wider range of students. Eligibility requirements typically involve demonstrating financial need through the completion of the Free Application for Federal Student Aid (FAFSA).

Examples of such programs include the Pell Grant, a federal grant program for undergraduate students with exceptional financial need, and various state-sponsored grant programs which often have specific eligibility criteria based on residency and financial circumstances. The application process generally involves completing the FAFSA form, which is then used by both the federal government and participating educational institutions to determine eligibility for various types of aid, including need-based grants and scholarships.

Institutional Scholarships

Colleges and universities themselves often offer a substantial amount of need-based financial aid to their students. These institutional scholarships are funded directly by the institution and are designed to support students enrolled in their programs. The amount of aid offered can vary significantly depending on the institution’s endowment, financial resources, and the overall demand for aid.

Application processes typically involve completing the institution’s own financial aid application, often in conjunction with the FAFSA. Many institutions use a holistic review process, considering both academic merit and financial need when awarding scholarships. Some institutions may also have specific scholarships targeted at students from particular backgrounds or with specific academic interests.

Private Foundations and Organizations Awarding Need-Based Scholarships

Numerous private foundations and organizations contribute significantly to need-based financial aid. These organizations often focus on specific areas of study, geographic regions, or demographic groups. Their application processes vary widely, ranging from simple online applications to more extensive essay-based submissions.

Examples of private foundations known for awarding need-based scholarships include the Bill & Melinda Gates Foundation, which supports scholarships for students pursuing various fields of study, and numerous smaller, community-based foundations that often focus on local students. Researching specific foundations aligned with your academic interests and background can significantly increase your chances of securing funding.

The Application Process for Need-Based Scholarships

Securing need-based financial aid requires navigating a specific application process. Understanding the common components, the critical role of accurate financial information, and employing effective strategies for essay writing are key to a successful application. This section will outline the steps involved and provide guidance on maximizing your chances of receiving funding.

The application process for need-based scholarships typically involves several key components, all designed to assess your financial situation and academic merit. A thorough understanding of these components is crucial for a successful application.

Common Components of Need-Based Scholarship Applications

Need-based scholarship applications generally require a combination of academic transcripts, standardized test scores (SAT or ACT), letters of recommendation, and a detailed financial profile. The specific requirements will vary depending on the scholarship provider, but these elements consistently form the core of the application. Academic transcripts demonstrate your academic performance and potential, while standardized test scores offer another metric of academic ability. Letters of recommendation provide external validation of your character and abilities. Finally, the financial profile, typically submitted through a CSS Profile or FAFSA, is central to determining your eligibility for need-based aid.

Importance of Accurate and Complete Financial Information

Providing accurate and complete financial information is paramount. Inaccuracies or omissions can lead to application rejection or, even worse, the withdrawal of awarded funds after discovery of the discrepancies. The scholarship committee uses this information to determine your financial need, and any misrepresentation undermines the integrity of the process and could be considered fraudulent. Be sure to gather all necessary financial documents, including tax returns, bank statements, and pay stubs, well in advance of the application deadline to ensure accuracy and completeness. Remember, this information is treated confidentially.

Step-by-Step Guide for Completing a Need-Based Scholarship Application

A systematic approach to the application process can significantly increase your chances of success. Following these steps can help streamline the process and reduce stress.

- Research Scholarships: Begin by identifying scholarships that align with your academic goals and financial need. Explore resources like Fastweb, Scholarships.com, and your school’s financial aid office.

- Gather Required Documents: Compile all necessary documents, including transcripts, test scores, letters of recommendation, and financial information. Maintain organized digital and physical copies.

- Complete the Application Form: Carefully read and follow all instructions on the application form. Ensure all information is accurate and complete.

- Prepare Financial Documents: Complete the required financial aid forms (e.g., FAFSA or CSS Profile) honestly and accurately. This is crucial for determining your eligibility.

- Write a Compelling Essay: Craft a well-written essay that clearly articulates your financial need and its impact on your educational aspirations. Show, don’t tell, your challenges and resilience.

- Request Letters of Recommendation: Ask for letters of recommendation from teachers, counselors, or other individuals who can speak to your academic abilities and character well in advance of the deadline.

- Review and Submit: Thoroughly review your application before submitting it. Proofread carefully for any errors in grammar or spelling.

Examples of Effective Strategies for Writing Compelling Scholarship Essays Focusing on Financial Need

The essay is your opportunity to connect with the scholarship committee on a personal level. Avoid simply listing financial hardships; instead, focus on how these challenges have shaped your character and strengthened your determination to succeed.

For instance, instead of writing “My family struggles financially,” you might write, “Balancing work and school has taught me the value of time management and perseverance, skills that will serve me well in college.” Another example: instead of stating “We can’t afford college,” you could write, “Witnessing my parents’ sacrifices to provide for my education has instilled in me a deep appreciation for the opportunities before me, and I am committed to making the most of them.” Remember to maintain a positive and hopeful tone, highlighting your resilience and ambition. Show how receiving the scholarship would enable you to pursue your educational goals and contribute to society. The essay should demonstrate your understanding of the value of the opportunity and your commitment to making the most of it.

Factors Influencing Need-Based Aid Eligibility

Determining eligibility for need-based financial aid is a multifaceted process, considering various aspects of a student’s and their family’s financial circumstances. Understanding these factors is crucial for students seeking this vital support for their education. The primary factors are interwoven and influence the final determination of financial need.

Family Size and Income’s Impact on Eligibility

Family size and income are the most significant factors in determining need-based aid eligibility. Larger families generally demonstrate greater financial need due to increased expenses related to housing, food, and other necessities. Similarly, lower family income directly correlates with a higher likelihood of qualifying for aid. Many need-based aid programs utilize a standardized formula, such as the Federal Methodology, to calculate the Expected Family Contribution (EFC), which considers both family size and income, along with assets. A lower EFC indicates a greater financial need and thus a higher chance of receiving aid. For example, a family of six with an annual income of $40,000 would likely have a lower EFC than a family of two with an annual income of $100,000. The specific income thresholds and family size considerations vary depending on the individual institution or funding organization.

Comparison of Financial Need Calculation Methods

Several methods exist for calculating financial need, each with its nuances. The most common method is the Federal Methodology used in the FAFSA (Free Application for Federal Student Aid). This method considers adjusted gross income (AGI), untaxed income, assets, and family size to determine the EFC. Some institutions may use their own proprietary formulas, which might include additional factors or weight certain aspects differently. For instance, some institutions might place more emphasis on the family’s liquid assets, while others might give greater weight to the number of dependents. The differences in these methods can lead to variations in the calculated financial need, resulting in different aid packages from various institutions.

Factors Beyond Income and Family Size

While income and family size are paramount, other factors can significantly impact need-based aid eligibility. These include exceptional circumstances such as unexpected medical expenses, job loss, or natural disasters. A student with a documented disability may also have additional expenses related to specialized equipment, therapies, or accommodations, influencing their need for financial assistance. Furthermore, the cost of attendance at the specific institution plays a critical role. A higher cost of attendance will naturally increase the demonstrated need even if the family’s income and size remain the same. The availability of institutional aid also varies, with some institutions having larger endowments and more generous aid programs than others.

Situations Increasing the Likelihood of Receiving Need-Based Aid

Understanding situations that increase the likelihood of receiving aid can help students and families effectively prepare their applications.

- Low family income relative to the cost of attendance.

- Large family size with multiple dependents.

- High medical expenses or other significant unexpected costs.

- Unemployment or significant job loss within the family.

- Presence of a disability requiring specialized care or equipment.

- Attendance at a high-cost institution with limited family resources.

- Demonstrated exceptional academic achievement or talent.

Maximizing Chances of Receiving Need-Based Aid

Securing need-based financial aid requires a proactive and strategic approach. By implementing effective strategies in your scholarship search and application process, and by actively engaging with your institution’s financial aid office, you significantly increase your likelihood of receiving the support you need to pursue your education. This section outlines key strategies to enhance your chances of success.

Effective Strategies for Searching and Applying for Multiple Scholarships

Finding and applying for numerous scholarships is crucial. A wider net casts a broader reach, increasing the chances of securing funding. Start by utilizing online scholarship databases such as Fastweb, Scholarships.com, and Peterson’s. These resources allow you to filter searches based on criteria like major, GPA, and financial need. Additionally, explore scholarships offered directly by colleges, universities, professional organizations, and community groups. Remember to meticulously track deadlines and requirements for each application to avoid missing opportunities. Creating a spreadsheet to organize applications, deadlines, and required materials can be invaluable.

Seeking Guidance from Financial Aid Offices

Financial aid offices possess extensive knowledge of available resources and application processes. They can provide personalized guidance on identifying suitable scholarships, completing applications effectively, and navigating the complexities of financial aid. Regular communication with your financial aid counselor demonstrates your commitment and allows them to offer tailored support. This includes reviewing your applications for completeness and accuracy, and potentially advocating on your behalf. Proactive engagement is key to leveraging the expertise within these offices.

Effectively Communicating Financial Need in Application Materials

Clearly and concisely articulating your financial need within scholarship applications is critical. Provide specific details about your family’s income, expenses, and any significant financial challenges impacting your ability to afford college. Avoid vague statements; instead, use concrete examples to illustrate your circumstances. For example, instead of saying “My family struggles financially,” specify “My family’s annual income is $X, and we are facing significant challenges covering the cost of tuition, housing, and living expenses.” Supporting documentation, such as tax returns or financial statements, can strengthen your application. Honesty and transparency are paramount in this process.

Maintaining Good Academic Standing

Maintaining a strong academic record is paramount for securing need-based aid. Many scholarships require a minimum GPA, and a high GPA demonstrates your commitment to your education and increases your competitiveness. Good academic standing not only improves your eligibility for scholarships but also strengthens your overall application for financial aid. Consistent academic success reflects positively on your character and potential, making you a more attractive candidate for financial assistance. A commitment to academic excellence significantly increases your chances of securing the necessary financial support.

Illustrative Examples of Need-Based Scholarships

Understanding the practical application of need-based scholarship criteria is crucial. The following examples showcase the diversity of available scholarships and the potential impact they can have on students’ lives. Note that specific details, such as deadlines and award amounts, can change yearly, so always verify information directly with the scholarship provider.

The Bill & Melinda Gates Millennium Scholars Program

This highly selective program provides scholarships to outstanding students with significant financial need who are the first generation in their families to attend college. Eligibility requires U.S. citizenship, high school graduation, and demonstrated financial need. Applicants must also have a minimum GPA and excel in leadership, community service, and academic achievement. Application deadlines typically fall in the late fall or early winter. Award amounts cover tuition, fees, room, board, and books, and can extend beyond a four-year undergraduate program.

The Gates Millennium Scholarship offers a transformative opportunity. For a first-generation college student from a low-income background, the financial burden of higher education can be insurmountable. This scholarship removes that barrier, enabling recipients to focus on their studies without the crushing weight of debt. It empowers them to pursue ambitious academic goals and contribute meaningfully to society after graduation, breaking cycles of poverty and achieving their full potential.

The Ronald McDonald House Charities Scholarships

These scholarships are designed to support students who have demonstrated financial need and are pursuing post-secondary education. Eligibility requirements vary by location and participating Ronald McDonald House Charities chapters, but generally include academic achievement, community involvement, and a clear demonstration of financial hardship. Application deadlines and award amounts also vary, often with applications open in the spring and awards ranging from a few hundred to several thousand dollars per year.

Receiving a Ronald McDonald House Charities scholarship can be life-altering for many students. The funds may not cover the entire cost of tuition, but even partial support can alleviate significant stress and allow recipients to concentrate on their education. This can lead to improved academic performance, increased confidence, and the ability to graduate without accumulating crippling debt, thereby enabling them to pursue their career aspirations and improve their quality of life.

The Pell Grant

While not strictly a scholarship in the traditional sense, the Pell Grant is a crucial source of need-based financial aid for undergraduate students. Eligibility is determined by the student’s Expected Family Contribution (EFC), as calculated by the Free Application for Federal Student Aid (FAFSA). The higher the financial need, the larger the Pell Grant award. There is no separate application for the Pell Grant; eligibility is determined automatically upon completing the FAFSA. Award amounts vary annually and are adjusted based on the student’s financial need and cost of attendance.

The Pell Grant acts as a cornerstone of financial support for millions of low-income students. By directly reducing the cost of college, it allows students to attend who otherwise might not be able to afford it. This access to higher education has a ripple effect, fostering economic mobility, increasing earning potential, and ultimately contributing to a more equitable society. The Pell Grant is often a critical component in allowing students to secure additional financial aid, including need-based scholarships.

Final Summary

Successfully navigating the world of need-based financial aid scholarships requires diligent preparation, a thorough understanding of the application process, and a proactive approach to searching for available opportunities. By carefully documenting financial need, crafting compelling narratives, and strategically applying for multiple scholarships, students can significantly increase their chances of securing the funding necessary to pursue their academic aspirations. Remember to leverage resources like financial aid offices and utilize the strategies outlined in this guide to maximize your success.